Why Everybody's Pretending Trump Didn't Threaten To Default

Nobody wants to send the global economy into a tailspin, so just act like you didn't hear.

On Super Bowl Sunday President Donald Trump threatened to default on some of the national debt and everybody pretended it wasn’t happening. He made the threat to a press gaggle on Air Force One, and there was no follow-up, probably because no financial reporters were present. Here is what Trump said:

We’re even looking at Treasury. There could be a problem—you’ve been reading about that, with Treasuries, and that could be an interesting problem because it could be that a lot of those things don’t count. In other words, that some of that stuff that we’re finding is very fraudulent, therefore maybe we have less debt than we thought of. Think of that!

National Economic Council chair Kevin Hassett did his best to clean this up. He explained that Trump was talking about not payments to bondholders but rather payments to contractors and recipients of government grants. “The Treasury secretary has found that the controls for spending of the previous administration were unacceptable,” Hassett said, “that they were sending money out without knowing where the money was going.” That last part may or may not be true, but it wasn’t what Trump was talking about. As I observe in my latest New Republic piece,

It’s on video, for Christ’s sake. (Fast forward to 21:15.) He said, “treasuries.” You aren’t imagining things. Your president is not a well man.

Yet the business press decided to half-believe the spin. Bloomberg: “It wasn’t immediately clear whether he was talking about US government debt, or payments processed through the Treasury Department.” Fortune: “President Trump did not specify whether he was referring to T-bills or government payments made via the Treasury Department.” Fortune then cited an Elon Musk tweet that was about neither treasuries nor contractors nor grantees but rather about entitlements. The Wall Street Journal, as best I can make out, didn’t report on Trump’s comment at all. The only truthful reporting I could find was in the Financial Times:

This is so wild that we’re inclined to assume and hope that markets will shrug it off as just another brain-fart from an administration that starts and ends trade wars within 24 hours…. any real and sustained suggestion that the US government could selectively default on some of its sovereign bonds — let alone “a lot” — would trigger a financial crisis so swift and severe that it would make any tariff tantrums seem puny in comparison.

The financial reporter Paul Blustein, formerly of the Washington Post and Wall Street Journal, elucidates the stakes further in his forthcoming book, King Dollar:

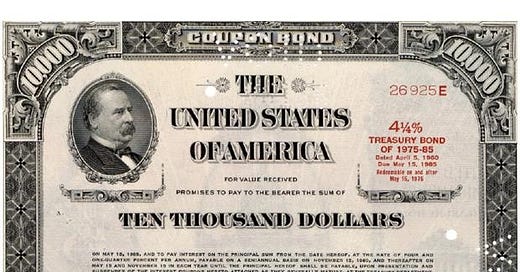

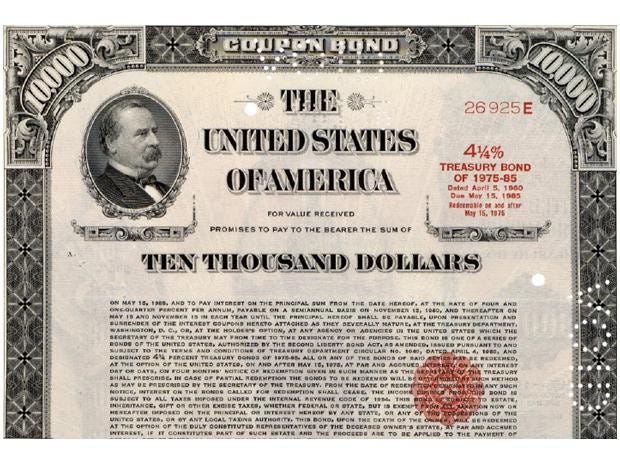

Proper functioning of the Treasury market can fairly be described as important for economic well-being in virtually every corner of the globe, because the daily churn of billions in Treasuries sets the yield for the closest thing in the world to a risk-free asset. That yield in turn serves as a benchmark against which investors and lenders assess all sorts of debts, such as bonds issued by other governments, short-term commercial paper issued by companies, business borrowings from banks, home mortgages, auto loans—the list goes on.

It’s hard to say whether Trump misunderstood what Musk told him, or Musk misunderstood what one of his twentysomething cybersleuths told him, or whether the twenthysomething cybersleuth got it wrong all by himself. Strange things happen to the truth when it passes successively through the minds of an overconfident baby-genius ignoramus; an overconfident middle-aged-billionaire ignoramus and ketamine fancier; and an overconfident malignant-narcissist ignoramus with dementia. But no Trump aide is going to say that Trump or anybody else was mistaken; they will instead say, like Charles Boyer in Gaslight, that you didn’t hear Trump correctly. If past patterns hold, Trump will repeat this threat to default until he gets a reaction, at which point he’ll probably get scared and deny he ever said it. But as I explain in my New Republic piece, Trump got rich stiffing creditors. You can read it here.

As Krugman has pointed out, the attempt to sweep this stuff under the rug and avoid a panic is allowing the craziness to advance further, meaning that when inevitably a rupture becomes unavoidable, it will be much worse than if the stock market had taken a huge dip earlier and scared him off.

This is a sharp take! Feels like everyone’s just pretending not to hear because the reality is too messy to deal with.