When House Republicans Say "Cut the Deficit" They Really Mean "Cut Taxes on Rich People and Corporations"

The case of bonus depreciation.

In 2002 President George W. Bush signed into law the Job Creation and Worker Assistance Act. The purpose was to stimulate the economy after the 9/11 attacks. Among its provisions was the introduction of something called “bonus depreciation,” which accelerated the pace at which corporations could deduct capital investment from their taxes. Where previously a corporation could typically deduct 14 percent of a capital expenditure in the first year, bonus depreciation raised that to 44 percent. That first-year deduction was raised subsequently to 50 percent and then, under President Donald Trump, to 100 percent.

Did it work? Not really. Capital investment never recovered from the 2007-2009 recession, and it still hasn’t. Economic studies of bonus depreciation’s efficacy have concluded (here and here) that its impact is modest. Even Trump’s own Treasury Department said, before passage of the 2017 tax law, that only about half the firms eligible to take advantage of bonus depreciation had bothered to do so.

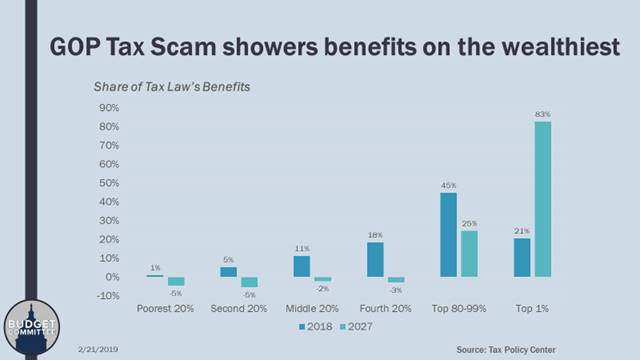

The 2017 law reduced the top corporate tax rate from 35 percent to 21 percent. In a vague gesture toward making up the lost revenue ($1.7 trillion thus far), bonus depreciation was boosted to 100 percent but later phased downward to 80 percent (that’s what it is today), then to 60 percent, and finally, in 2026, to zero. The hope was that this would create a “come and get it while supplies last” stampede to increase capital investment. That didn’t happen, perhaps because everybody figured Congress wouldn’t allow the phaseout to get very far. And in fact, House Republicans, immediately after they passed the debt-limit deal, started looking for ways to piss away most of the $1.5 trillion in deficit savings through tax cuts, including a revived 100 percent bonus depreciation. House Republicans don’t care in the slightest about reducing the budget deficit. They just pretend to as a cover for lowering taxes on corporations and rich individuals. Mission accomplished: According to the Institute on Taxation and Economic Policy, bonus depreciation saved 25 of the richest corporations in America $67 billion in taxes between 2018 and 2022. Now House Republicans want to do it again. The Senate won’t let them, but still, their gall is just astonishing. That’s the subject of my latest New Republic piece. You can read it here.