Trump v. Reagan

In two rare instances when the Gipper got tax policy right, Trump wants to reverse him.

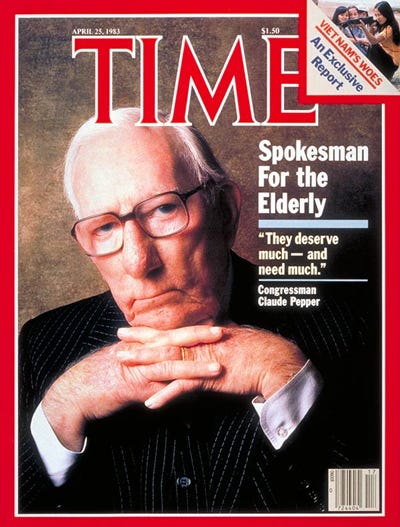

Taxing Social Security benefits was OK with Rep. Claude Pepper of Florida, the most pro-elderly legislator who ever lived. Why isn’t it OK with Donald Trump?

President Ronald Reagan apparently used to say (I can’t identify a source) that if you want more of something, subsidize it, and if you want less of something, tax it. Most economists would agree. Donald Trump proposed in June that tips should be tax-free, and Kamala Harris last weekend agreed with him. This is a bad idea for various reasons, as I explain in my latest New Republic piece, and Trump’s more recent suggestion that Social Security benefits be tax-free is a bad idea, too. Surprisingly, both proposals would replace policies that Reagan, who’s remembered more for his tax cuts than his tax increases, put in place in 1982 and 1983, when I was a young policy-wonk reporter in Washington.

When tips are taxed, you get less tipping, per Reagan’s dictum. When tips are not taxed, that’s a kind of subsidy relative to other forms of compensation, so you get more tipping. I’m all for workers getting fat tips, but not through the tax system, because extending a tax subsidy to tips would expand the tipped labor force. The tipped labor force constitutes 2.5 percent of the total, according to the Yale Budget Lab, and a surprisingly low 5 percent of the bottom quarter of the income distribution. I don’t want that share to grow.

As I explained last December, tipping is inegalitarian because it makes worker and customer servant and master. That isn’t just my view. In the United States at the turn of the 20th century, tipping was judged so much a statement of social superiority that you risked insulting a white man if you offered him a tip. (A Black man was understood in those days to occupy an inferior caste, so it was OK to tip, for instance, a Pullman porter.) The taboo gradually faded away, in a modest step forward for racial equality. But the result was greater class inequality as workers of all races were made supplicants for an honest day’s pay.

For years, the master-servant aspect of tipping confounded tax policy. Under the 1938 Fair Labor Standards Act, which established a minimum wage and a 40-hour work week, the government chased its tail over the question of whether a tip was a gift, and therefore no more taxable than a Christmas present from Mommy and Daddy, or a part of a worker’s salary, and therefore taxable like any other labor income. While the government dithered, pretty much nobody paid taxes on tips. In 1982, though, the Gipper (and, yes, a Democratic Congress) imposed paperwork requirements on tipped workers that made it harder for them to dodge federal taxes. Effectively, taxation of tips begins with passage of the Tax Equity and Fiscal Responsibility Act of 1982 (we nerds call it TEFRA), a law that tried to plug the revenue hole left by Reagan’s 1981 tax cut.

Social Security benefits went untaxed until 1983, when Reagan and the Democratic Congress, facing yet another revenue hole—this time not Reagan’s fault—passed a bill to save Social Security from imminent insolvency. As a result of that law, part (though not all) of Social Security benefits became taxable. It was hard to justify treating over-65s as deserving special protection when they were wealthier than the population at large. Even Rep. Claude Pepper (D.-Fla.), Congress’s preeminent champion for the elderly—you can blame the outlawing of most mandatory retirement largely on Pepper—voted to tax Social Security benefits.

Because Social Security benefits aren’t part of the market economy, subsidizing them by making them tax-free won’t result in more people getting Social Security (except perhaps in the sense that more people will start collecting benefits before they become eligible for the maximum benefit). But today Social Security is once again approaching insolvency, and the elderly possess an even larger share of the nation’s wealth than in 1983. Yet Trump is positioning himself to the left of Pepper. The Gipper would not be pleased. You can read my New Republic piece here.