Potlatch Chic

The luxury spending bubble has burst, and that's another triumph for Bidenomics.

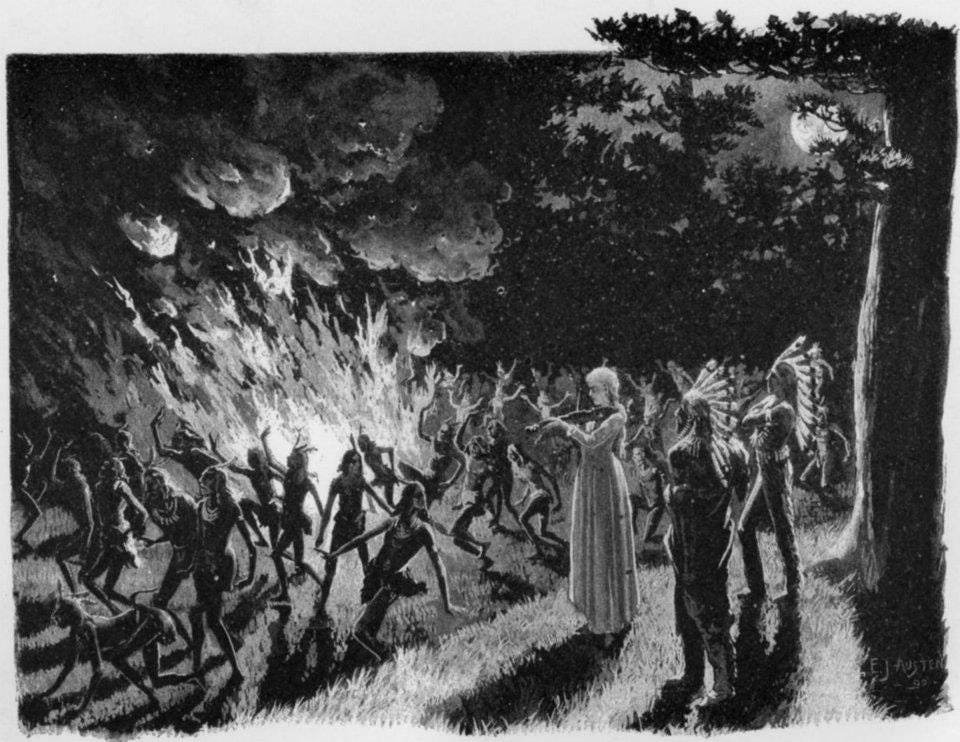

Native American tribes of the Pacific Northwest have a traditional ceremony called the potlatch in which a tribal chief or some other big shot would demonstrate his wealth by giving a lot of expensive stuff away or, better yet, destroying it. I can’t quarrel with a tradition of wealth redistribution (which is what tribes like the Kwakwaka'wakw of British Columbia today emphasize), but the bit about wealth destruction was very Real Housewives of Beverly Hills. Here is a passage describing the potlatch from Patterns of Culture, a 1934 text by the anthropologist Ruth Benedict:

The highest glory of life was the act of complete destruction… It was always done in opposition to a rival who must then, in order to save himself from shame, destroy an equal amount of valuable goods. The destruction of goods took many forms…. The host might send his messengers to break in pieces four canoes and bring the pieces to heap upon the fire. Or he might kill a slave. Or he might break a copper [i.e., a flat sheet of copper beaten into the shape of a shield, then painted or engraved and used on ceremonial occasions]…. A chief who did not feel the occasion great enough for the gift of his valuable copper might cut out a section of it, and it was then necessary for his rival to cut out a section from an equally valuable copper.

In a similar spirit, Neiman Marcus maintains an annual tradition of offering grotesquely extravagant Christmas gifts. There used to be just one but now there are several. This year, for $500,000 you can have yourself turned into a Disney animation and for $975,000 you can receive a bespoke Cadillac—”one of one commissioned”—on a two-day trip to Detroit. (Say it with me: “Second prize, five days in Detroit.”) The Neiman-Marcus gifts used to inspire newspaper stories but apparently the Anglicized potlatch that is the American luxury economy has grown so extravagant that they no longer qualify as news.

The last couple of years saw an especially frantic bubble of luxury spending on so-called “Veblen goods” in which waste was very much the point. But now, just in time for Christmas, that bubble has burst. In my latest New Republic piece I explain why this is a very good thing for everybody except trust-fund twits, and maybe for them, too. You can read it here.

One minor issue in the text: "Four 25 percent rate hikes followed" -- you mean 25 basis point (or 0.25%). If they'd done four 25% rate hikes, the rate would now be over 100%. :-|