Dear Senate parliamentarian

Raising the minimum wage will increase revenues in the out years. Ergo, it can be included in a reconciliation bill. Tell me where I'm wrong.

I’m no parliamentarian, but it seems to me that a minimum wage hike is perfectly all right to include in the Covid stimulus bill.

The Democratic leadership is counting on the Senate parliamentarian to rule today that an hourly minimum wage increase to $15, up from the current $7.25, can’t be included in a budget reconciliation bill under the Byrd rule, because the Democrats are, to a surprising degree, divided on the matter. The Covid stimulus was introduced as a reconciliation bill because a reconciliation bill can’t be filibustered; all it needs to pass is 51 votes, as most major legislation did before Senate filibustering spun out of control in the 1990s and the aughts.

The Byrd rule says that you can’t include anything in a reconciliation bill that produces no change or only “incidental” change in outlays or revenues. There are some other restrictions as well, but these don’t appear, to my untrained eye, relevant in this instance. But the Byrd rule also says you can do whatever you want if the measure in question would create “a substantial increase in revenues during fiscal years after the fiscal years covered by the reconciliation bill.” That’s because, according to the Congressional Budget Office, whose word must be law in this instance, raising the minimum wage would increase tax revenue by $19.7 billion (over 10 years, for fascinating distributional reasons that I explain here). This effect would continue in what budget wonks call “the out years.” As I understand the politics surrounding taxation policy circa 2021, there is absolutely no tax cut or tax increase that any member of Congress would ever be willing to describe in public as insubstantial.

So shut up already and put the minimum wage hike into the Covid bill.

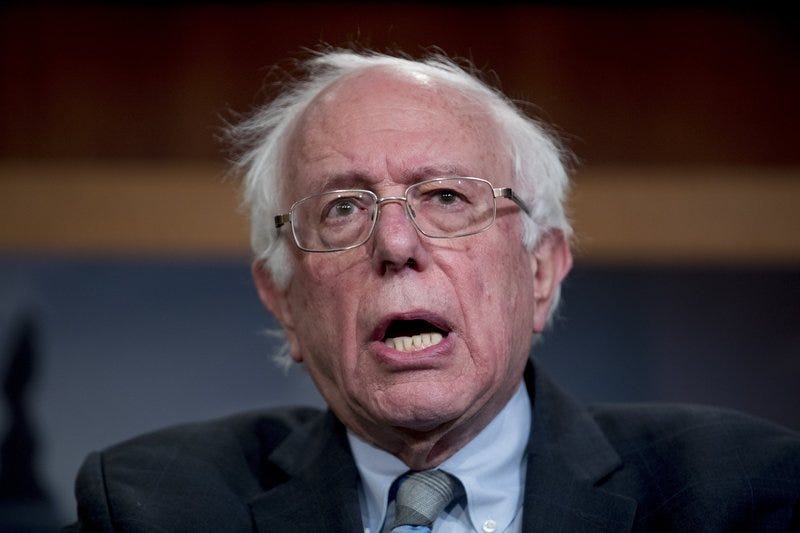

Sen. Bernie Sanders has a different argument. The minimum wage, despite its revenue-raising effects, nets out at a cost to the government of $54 billion over 10 years. I have argued, and I presume Sanders agrees, that the $15 minimum wage’s budgetary impact is fairly trivial in the larger scheme of things, and certainly it’s no reason to oppose its passage. But is it trivial enough to be “incidental”? That depends on precedent, and Sanders points out that the budget impact of two measures included in the 2017 Trump tax cut, which was also a reconciliation bill, was smaller. The two measures were opening up the Arctic National Wildlife Refuge to oil drilling and repeal of the Affordable Care Act’s “individual mandate” imposing a monetary penalty on anyone who didn’t acquire health insurance. In a tweet this weekend, Sanders wrote:

If Republicans could use reconciliation to try to take health care away from 32 million Americans by repealing the ACA, please don't tell me we can't use the same rules to provide a raise to 32 million workers by increasing the minimum wage to $15 an hour. No more excuses.

Sanders’ claim is based on a letter he received from the Congressional Budget Office that discusses how many budgetary functions would be affected by an increase in the minimum wage, as opposed to how many were affected by the ANWR change or by repealing the individual mandate. Raising the minimum wage would affect about 20 budgetary functions; opening up ANWR and eliminating the individual mandate affected about four and one, respectively.

CBO estimated in 2017 that opening up ANWR would reduce the deficit by $1.1 billion over 10 years, which is a lot less than the $54 billion that the minimum wage hike would cost. CBO also estimated in 2017 that repealing the individual mandate would reduce the deficit by $338 billion over 10 years (because many fewer people would take up the government’s offer of subsidized health insurance). That’s a lot more than $54 billion. So even if you’re going by the dollar amount, rather than the number of budget functions, the $54 billion that the minimum wage increase to $15 would cost the federal budget over 10 years fits comfortably within the range of ten-year expenditures that the parliamentarian previously judged non-incidental.*

If, despite all this, the minimum wage hike is struck from the Covid bill, then I don’t want to hear any crap, when it’s debated as a stand-alone bill, about how costly the legislation will be to the federal deficit. If that cost is too trivial to permit its inclusion in the Covid stimulus, then it’s too trivial to carp about when the Raise the Wage Act arrives shivering and naked and all by its lonesome on the Senate floor.

*Correction. An earlier version of this column botched the arithmetic and consequently suggested Bernie Sanders was perhaps being too clever by half. He is not. His reasoning is extremely sound here.

"CBO estimated that opening up ANWR would reduce the deficit by $1.1 billion over 10 years, which is a lot more than $54 billion."

I think you have a more/less typo here?